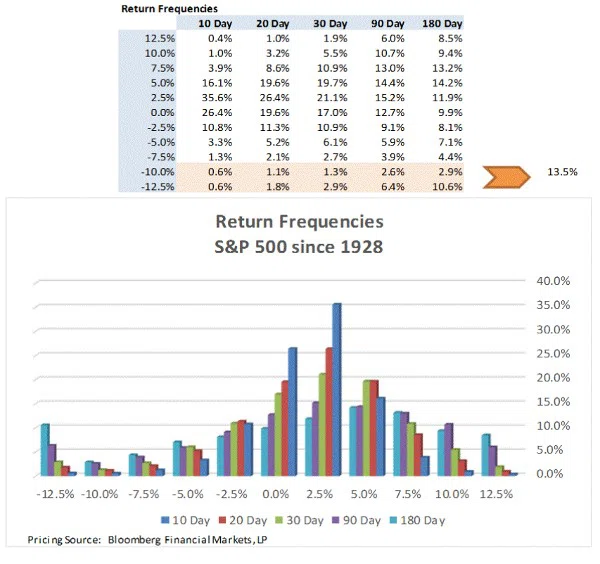

We are writing a quick note on recent market volatility to supplement our longer piece on markets around the world. Over the past 8 years, traders and investors alike have been anesthetized by central banks providing excess liquidity. Prior to this period, market’s regularly showed volatility in the ranges of 10 and 15% pull backs. Off a July 20th high, we are down 6.49% as of yesterday’s close (1990.26) and we had an 11.58% fall relative to the September low of 1884.09 (there was an August low of 1867.61) >read more

Related

2020 Q1 Quarterly Macroeconomic Review

Biltmore Family Office is an independent SEC-registered advisor to investment-oriented business owners and their families.

2023 Quarterly Review

Analyze the first half of 2023 and outlook on the year ahead with Biltmore Family Office's Chief Investment Officer, Rael Gorelick. Topics covered include bank runs, generative AI and interest rates.

2023 Q3 Quarterly Macro Review

It seems that we wake up each day to a new significant news story. It's hard to keep up. This quarter, we try to provide a relevant narrative out of the complex array of events bombarding us each day. Within that narrative, what does it mean for our investment allocations?